URD 2024

-

01 2024 business report

This universal registration document was filed with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority in accordance with Regulation (EU) 2017/1129, on 28 March 2025, without prior approval pursuant to Article 9 of said regulation.

The universal registration document may be used for the purposes of an offer to the public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus and a summary of all amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129.

-

A multi-disciplinary organisation

Eiffage Route team, place du Commerce in Nantes - Special award in the photography competition held in 2024 as part of the launch of the employer brand # FamilySpirit.

Eiffage is one of Europe’s leading construction and concessions groups. We generated revenue of €23.4 billion in 2024, which is 7.3% higher than in 2023.

Our Group is organised into eight complementary business lines spread across four divisions: construction, property development, urban development, roads, civil engineering, metallic construction, energy systems and concessions.

Every year, we carry out over 100,000 projects, most of them in Europe. Our Contracting segment now represents 40% of our business outside France.

Our Group is firmly anchored in the regions and benefits from the expertise of our 84,400 employees. Their commitment is our greatest strength in supporting our customers on a daily basis with the challenges of the digital and ecological transitions.

- → Urban development to restructure city centres and create new districts

- → Multi-product property development and new concepts incorporating changing uses

- → Design, construction and maintenance on both new-build and retrofitting projects

- → Locally focused Works & Services in building

2024 at a glance

The resilience afforded by the Construction division’s integrated builder and developer model was again plain to see amid a property development market in France, Belgium and Luxembourg at its lowest ebb since the downturn began in late 2022. In Poland, the property development business continued to develop. We kept the effects of the overall business contraction in check as our teams stepped up and we managed costs very tightly. Despite the impact of the new housing slump, our margins excluding property development improved, and our order intake again grew at a healthy rate of 7%, in particular as we clinched some major contracts. Urban development, an area in which we are one of the leading private-sector operators, allows us to secure land reserves over the long term and to showcase Group’s innovative solutions.

€4 billion

in revenue

in 2024-6.6%

revenue

in 2024 vs. 2023€142 million

in operating profit

on ordinary activities

in 2024€5.4 billion

order book at

31 December 202410,275

employees at

31 December 2024

2024 IN REVIEW

Summary on page 252 of the Directors’ report

The Construction division is confident for 2025 despite the tensions and fiercer competition in some of the markets we serve. Our main challenges will be maintaining the level of our order book. We intend to do so by relying on expanding markets, such as renovation and the growing demand for housing, by building up our off-site construction business, with a special focus on prefabricated wood solutions, and by introducing offerings and property concepts aligned with the latest market trends. The cross-disciplinary cooperation between Group’s business lines is another factor sustaining this momentum. The Nové contract in France, a prime example of this approach, covers housing works for the French Ministry of the Armed Forces worth over €1.5 billion, with €1 billion in works joining the order book in 2025 and 2026, and the corresponding production by year-end 2029. Elsewhere in Europe, the outlook is promising for our units in Belgium and Poland, as they are launching prestigious projects.

- → Design, construction and maintenance of onshore and offshore infrastructure

- → Road works, urban development, and roadways and utilities, industrial production for roads

- → Design, manufacture and assembly of metal structures

- → Multi-technical solutions for industry

- → Demolition, selective deconstruction, recycling and direct re-use

2024 at a glance

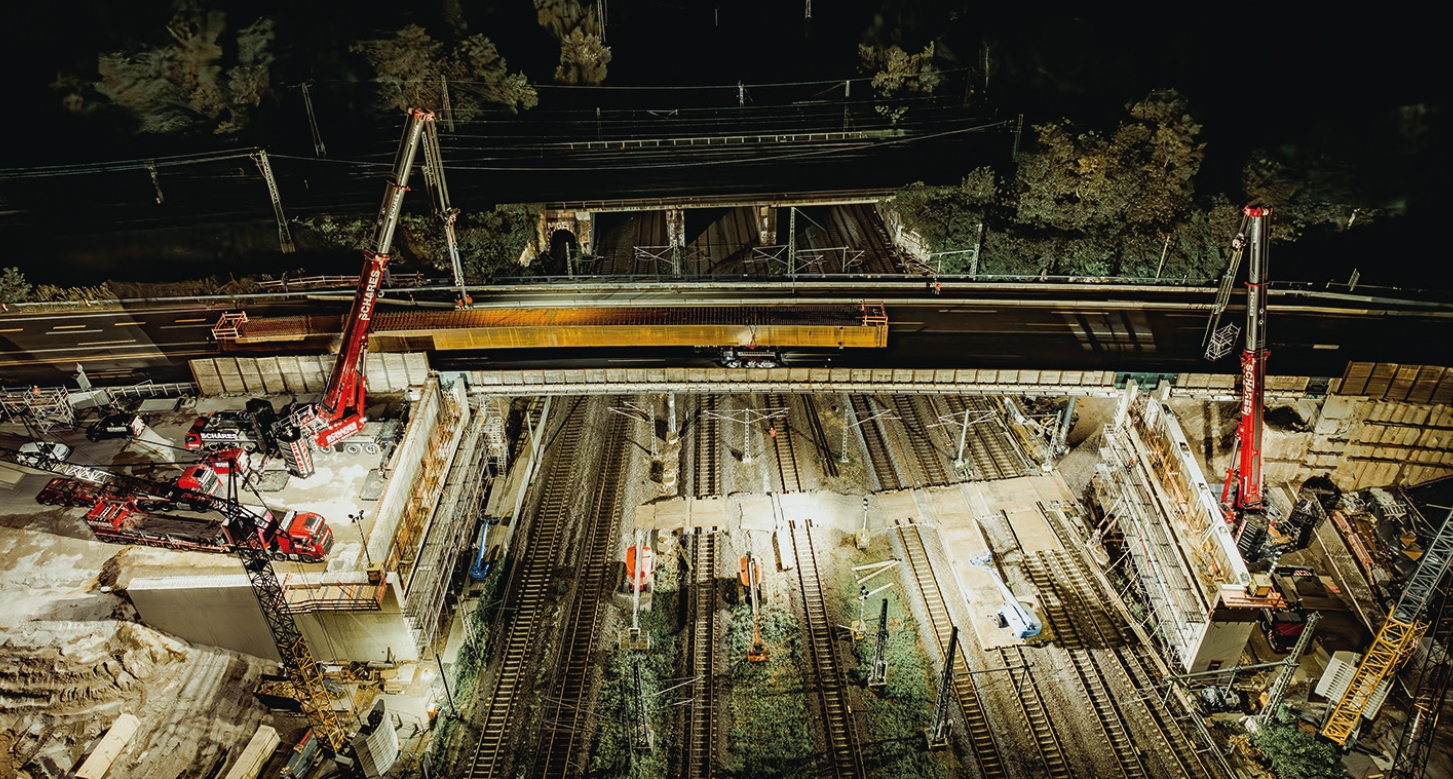

The division’s order intake posted another increase in 2024 (+5%). Eiffage Génie Civil’s main markets – transport, energy and industry – reaped the benefit of their strong fundamentals, including demand for mobility, infrastructure servicing, the need for decarbonised energy and the European drive for industrial and energy sovereignty. The maritime construction business excelled in the export model business. Eiffage Métal enjoyed strong business trends in Europe, with offshore wind generating orders worth over €1.5 billion. Amid a downturn in new road works, Eiffage Route continued to build up new businesses in France and Spain focused on mobility, resilient urban development, water management and utilities contracts for industrial and logistics sites.

€8.4 billion

in revenue

in 2024+4.6%

revenue

in 2024 vs. 2023€278 million

in operating profit

on ordinary activities

in 2024€15.2 billion

order book at

31 December 202430,494

employees at

31 December 2024

2024 IN REVIEW

Summary on page 249 of the Directors’ report

The division’s order book is in great shape. It contains several years’ work on major projects, such as civil engineering for the Penly EPR2-type reactors, the Lyon-Turin railway tunnel, Line 15 East of the Grand Paris Express project, the Toulouse metro, the Rhine-Main energy corridor in Germany and several offshore wind farms. Under the export mode, work will continue on the HS2 high-speed rail line in the United Kingdom, the E18 motorway in Norway and the port projects chiefly in Africa and South America. Given their complex nature, these projects require multidisciplinary expertise. Eiffage Route will concentrate on enhancing the quality of its offerings and creating value through innovation to deliver resilient and connected roads and urban development. On a broader scale, it will also focus on making the necessary changes to address the changes in its markets. The circular economy will remain a key point of focus at its quarries and its hubs.

- → Design, production, operation and maintenance of electrical, industrial, HVAC and energy equipment and systems

- → Customised offerings for the industry, infrastructure and networks, local authorities, and the commercial sector

2024 at a glance

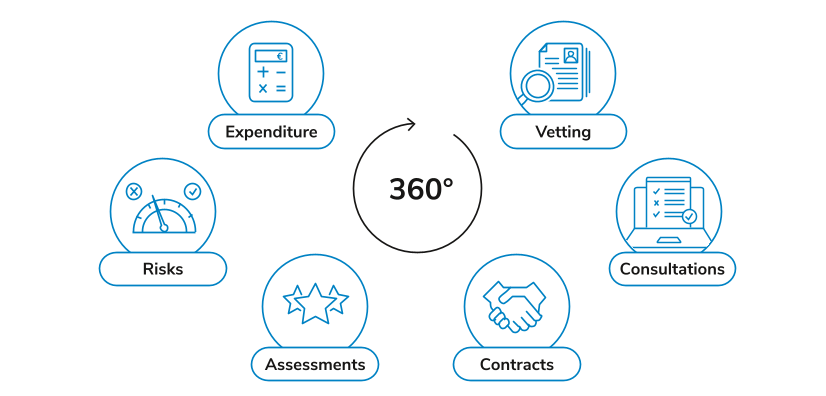

Through several years of strong growth, the Energy Systems division has gained a whole new dimension as exemplified by its revenue trends (up 50% since 2021) and its ability to design and build major complex projects. It worked on over 200 in 2024, up from 30 five years earlier. Today it ranks as one of the leaders in Europe’s energy services market. We kept up the rapid pace of our acquisitions drive in 2024, agreeing or finalising 12 deals, including for Eqos in Germany where we now have a nationwide footprint. We also strengthened our positions in Switzerland and the Netherlands. The contracts we handle have grown in size and complexity, partially as a result of the Group’s synergies. We have made the transition from installation contractors to integrators, and we now act as general contractors in energy. We completed major rail, data centre and healthcare projects. The implementation of our business guidelines has given us a structured approach to project monitoring, while keeping our organisation compact and decentralised.

€7.2 billion

in revenue

in 2024+21.3%

revenue

in 2024 vs. 2023€420 million

in operating profit

on ordinary activities

in 2024€8.2 billion

order book at

31 December 202437,716

employees at

31 December 2024

2024 IN REVIEW

Summary on page 247 of the Directors’ report

The ecological transition, the digital transition and the quest for industrial and energy sovereignty are our main business drivers. We will continue to build out and standardise our processes across Europe in order to better meet our customers’ needs, with the latest embedded digital technologies increasingly prevalent in our offerings. We intend to push ahead with our offensive strategy in countries where we already have a foothold. We want to establish all our businesses and markets there, and ultimately we aim to rank among the top five. Our expansion powered by organic and acquisition-led growth has bulked up the proportion of our business generated in Europe, with revenue outside France expected to contribute close to 45% of the total in 2025. With the order book up 27% in 2024, hiring and onboarding new teams represents a major challenge to keep our momentum going.

- → Financing, design, construction, maintenance, servicing or commercial operation of the structure built, motorways and toll motorways under concessions

- → Management of major projects for public facilities, transport infrastructure, renewable energy production and buildings

2024 at a glance

The Concessions division experienced strong activity, highlighted in particular by the award of the 55-year concession for the A412 motorway in the Haute-Savoie department. Activity under the Nové contract with the French Ministry of the Armed Forces gained steam. The project to build France’s largest technical and maintenance rail centre at Villeneuve-Saint-Georges started up, and we launched the initial major maintenance overhaul of the Bretagne-Pays de la Loire high-speed rail line. The addition of the Maribay Toulon Plaisance concession was the main focus of our port business. In motorway concessions, we marked the opening of the first very high-power charging corridor for electric trucks between Paris and Lyon, the deployment of new payment types for the free-flow toll gates, the inauguration of a new interchange at Chalon-sur-Saône, the Millau viaduct’s 20th anniversary and the launch of an ambitious customer engagement charter. Note the introduction of a new tax on long-distance transport infrastructure had a major impact.

€3.9 billion

in revenue

in 2024+6.5%

revenue

in 2024 vs. 2023€1.7 billion

in operating profit

on ordinary activities

in 20244,967

employees at

31 December 2024

2024 IN REVIEW

Summary on page 244 of the Directors’ report

The division will pursue its strategy of expanding and diversifying its asset portfolio. Its focus will be on managing large building complexes, port and airport infrastructure and developing renewable energy projects via Sun’R. Planning ahead for the end of some concessions, we will focus our development on long-term projects that harness synergies available to the Group. We will also benefit from the momentum of our new solutions such as Ferlioz, a rail infrastructure management specialist. Under the Mobility Investment Plan agreed in 2023 by APRR and AREA, we will commence the public consultation for the A6 Nord motorway development project, and we will continue to introduce ticket-free access on the A43 and the A41. Our concession companies will maintain their customer service and low-carbon mobility commitments to deliver freer-flowing and more environmentally friendly motorways.

-

Spurred on by our accomplishments

Eiffage demonstrated its positive momentum in France and the rest of Europe during 2024, a highly productive year with various standout achievements and events.

Leveraging its local roots and its expertise, our Group completed some large and complex projects and brought to fruition multiple developments of all sizes.

Driven by their complementary nature and the synergies between the Group’s business lines, our offerings are evolving to provide tailored and appropriate responses to our clients’ challenges.

We are steadfastly pursuing our ambition for the coming years of making the difference through a sustainability-led approach right across our ecosystem.

All our energy is directed towards innovating, designing, building, maintaining and renovating the cities and infrastructure of the future, with usage at the focal point of our approach.

The Millau viaduct:

The record-setting Millau viaduct remains an outstanding accomplishment. It has a place all of its own in the history of Eiffage which will operate it until 2079.

The Millau viaduct spanning the Tarn Valley was designed by architect Sir Norman Foster and engineer Michel Virlogeux. It features a whole array of innovations and to this day remains Europe’s highest cable-stayed bridge. It was built using the latest technologies, including lasers and GPS for alignment purposes, translators to move deck sections into place, self-climbing formwork and high-performance concrete. It was completed in just three years from 2001 to 2004 by a workforce of 3,000. At its highest point, it stands 343 metres above ground, making it 13 metres taller than the Eiffel Tower.

Construction of the Millau viaduct was a turning point in Eiffage’s recent history. It helped to forge our reputation and took us to the next level. It illustrates our Contracting and Concessions model. It embodies our expertise and the pride we take in building sustainable infrastructure that changes regions for the better. With our acquisition of full ownership of the concession operator in late 2023, we reaffirmed our attachment to the viaduct while strengthening our concessions portfolio. Close to 50 of our employees apply their expertise daily for the benefit of the Millau viaduct and its numerous customers.

The viaduct connecting the Causse Rouge in the north to the Causse du Larzac in the south has become a major tourist attraction – and indeed a symbol – for the town of Millau, the department and the region. It is also a national monument in its own right and attracts a large number of visitors. Every year, more than 800,000 people stop off at the viewing area, making it one of France’s top ten most visited sites outside the Paris region. More importantly, it serves a practical purpose, since five million vehicles cross it every year.

A month-long series of events was organised in September 2024 to celebrate the 20th anniversary of its opening. The festival reached a climax with the 7th Course du Viaduc de Millau en Aveyron race on 22 September. For the first time, a 12.8-kilometre race was organised alongside the usual 23.7-kilometre event. All in all, more than 9,000 runners entered and were cheered on by more than 20,000 spectators. A tightrope walk during the race by Nathan Paulin across a line stretched between two pylons of the viaduct and a flyover by the Patrouille de France, the French Air Force’s aerobatic team, added to the weekend’s excitement.

QUESTIONS À…

Éric Laporte

Technicien en charge du suivi des infrastructures Eiffage Concessions

What’s your connection to the viaduct?

I joined the patrol team in late 2004, one month before the Millau viaduct entered service. I was immensely proud to have been picked from a large number of applicants. Later I became a technician in charge of infrastructure monitoring. Today, I hold even more responsibilities, as I’m also traffic flow and safety team leader.

How do you feel when you’re standing on the viaduct?

I have a real sense of having a job to do. It’s a bit like being the viaduct’s “guardian angel”. I make sure it’s in good shape and our customers can cross it as safely and smoothly as possible. Its beauty and vast size still take my breath away. You never grow tired of working in such an amazing location!

Is there anything about the viaduct that still sends a tingle down your spine?

I’m fortunate in being able to go to barely-known areas that are off-limits to the public, such as the underside of the bridge deck, via the negative platform. It’s 270 metres above the river below, and it makes you feel so small.

Do you have any particular memories you’d like to share?

Back in 2006, there was a very heavy snowstorm with the carriageway covered in one metre of snow. We had to close the viaduct to traffic as a result. Everyone chipped in to clear the snow and look after stranded motorists.

-

Guided by our strategy

Phase 2 works on the electric battery gigafactory project in Douvrin harnessing synergies between several Eiffage business lines for the ACC joint venture.

Leveraging its compact and decentralised organisation, the Group maximises the strength of its collective efforts.

We have positioned ourselves to capitalise on European underlying trends powering our growth. The quest for industrial sovereignty through reindustrialisation, energy sovereignty through diversification of energy sources and the development of sustainable mobility solutions are among these key drivers.

With our emphasis on decarbonising our activities, we also contribute to the decarbonisation of our customers and the regions where we are located.

These economic and environmental challenges are reshaping our business activities, providing powerful sources of growth, with multiple areas of cooperation between our business lines, and giving us an opportunity to better meet our customers’ expectations.

Today, our energy services business lines are experiencing particularly strong growth, reinforcing their position alongside our construction and property development, and our concessions business lines.

Resolutely European

Eiffage had a very good year in 2024. Our revenue grew by more than 7% and our earnings rose by 3% despite the significant impact of the new tax on long-distance transport infrastructure.

The Group is strong. Our visibility is at an all-time high, and we have the financial resources to keep developing. Our strategy is understood and acknowledged. Our compact organisation, which safeguards our corporate culture, facilitates cross-disciplinary cooperation between our business lines and is crucial for harnessing our areas of expertise for the benefit of our customers.

Our energy services businesses are growing rapidly, reinforcing their position alongside our construction and property development, and our concessions business lines. Two factors account for this shift: the intrinsic dynamics in the energy markets, boosted by digitalisation, and the multiplier effect of our strategy of acquisitions. We have two main objectives: enhancing our regional coverage and strengthening or acquiring more and more areas of expertise to elevate our offerings.

In 2024, we made several acquisitions in France, Switzerland, the Netherlands and Germany, a country where we scaled up to reach a whole new dimension. It is now our second-largest country after France. Thanks to this strategy, our Group is establishing itself as a major European player in construction and property development, energy services and concessions.

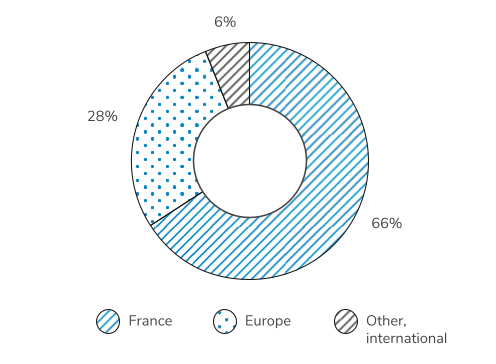

Europe represents 96% of the Group’s revenue. Europe’s environmental aspirations are evident and implemented in all the countries in which we operate. Over the past five years, these ambitions have also been supported by an ongoing quest for digital, industrial and energy sovereignty. Goals that have gained real traction amid the geopolitical challenges of today’s world. They have coalesced into core trends, which will continue to underpin all our business lines over the next few years. Our strategic fit and our European roots provide us with a firm foothold on which we can confidently build going forward.

The energy and digital transitions, powerful accelerators closely linked to decarbonisation, are a boon for all our business lines.

The ramp-up in renovation in the construction segment, the growth of energy businesses and their maintenance and steering components, the development of sustainable mobility and the increasing photovoltaic, wind and nuclear energy generation highlight this. All these opportunities provide us with robust growth drivers in the Contracting segment.

In our Concessions segment, there are equally large growth opportunities. These include the investments needed to adapt port infrastructure to climate change and to support the emergence of electric mobility and changing traffic trends in our motorway concessions. And we should not omit to mention the Nové project to renovate and build housing for French Ministry of the Armed Forces personnel as part of an ambitious environmental programme.

Digitalisation unlocks value from data for all our business lines, with reliability and security paramount among our concerns. It makes a difference in our offerings and in the service we provide to our customers. Today, infrastructure and buildings are becoming increasingly smart, autonomous and controllable.

The ecological and energy transitions challenges are impacting our business lines, and that means we need to pursue an ambitious policy of skills and career management for our teams. Collectively, our job is to support and guide our employees as our business lines evolve.

The quality of the men and women in our teams really stands out. By retaining and helping them to progress in their careers, irrespective of their role, we will provide a fulfilling and rewarding environment for everyone. In turn, this will help Eiffage to thrive and enhance its reputation.

-

Anchored in Europe for the long term

Heldentoren residential tower in Knokke-Heist (Belgium) delivered in 2024 by Eiffage Construction’s teams.

Our vibrant growth in European countries, the strength of our order books and the synergies between our business lines are indicative of effectiveness of our Europe-centric strategy.

We are continuing to grow and develop through organic growth in our existing entities and through acquisitions targeting companies firmly established in the areas they serve. Through this process we have been expanding our regional coverage and the positions held by our business lines and their areas of expertise. We strive to integrate their teams, their expertise and their market knowledge so we can continuously broaden the Group’s footprint in the relevant country.

Our growth trajectory is reshaping the Group, with 36% of our Contracting revenue now generated in Europe (excluding France), or two times more than ten years ago.

Germany

Eiffage is a well-respected operator, with long-standing positions in civil engineering, road, rail, metallic construction and, to a lesser extent, in buildings and energy services. Through our recent acquisitions, we have now scaled up to achieve nationwide coverage in energy services.

Activity in the German infrastructure market has been underpinned by the programmes to upgrade the road and rail networks, many of which date back to the post-Second World War era. The imperative of installing new power grids to support the development of renewable energies is another key driver. Our business momentum has been boosted by the very high level of orders received in recent years. The 30-year concession awarded in 2020 to build the 76 kilometre section of the A3 motorway between the Biebelried and Fürth/ Erlangen junctions is a prime example. To date, it is Germany’s largest public-private motorway partnership agreement. After it enters service in 2026, our teams will be freed up to start work on the energy corridor contract awarded to us in 2024 by Amprion. All in all, a 600 kilometre cable conduit system needs to be built by 2032 to carry power from offshore wind farms in the North Sea to southern Germany. Eiffage Métal’s teams, via our SEH subsidiary, are also actively working on structures, such as the Mülheim and Leverkusen bridges, plus station upgrades, such as Ostbahnhof in Berlin.

Eiffage Énergie Systèmes has gained a whole new dimension in Germany through the game-changing acquisitions of Salvia and Eqos. These deals have significantly expanded its regional coverage, broadened its areas of expertise and given it a foothold in Austria. Salvia operates in the commercial and industry segments, while Eqos specialises in high-voltage power T&D, telecommunications and rail sectors. Eiffage Énergie Systèmes now has a workforce of 4,800 employees in Germany and it will generate €1.1 billion in revenue from 2025. With Eiffage Énergie Systèmes’ long-standing units in Germany, we are now a leading force in the country’s energy services market. Germany is now Eiffage Énergie Systèmes’ third-largest market after France and Spain.

-

Bolstered by our key strengths

Employees at the Climate Fresk workshop held on the Pierre Berger Campus at Eiffage University in Vélizy-Villacoublay.

Their commitment on a daily basis and the very high proportion of them taking part in the employee share ownership plan are a testament to the attachment they have for the Group and the family spirit that binds us all.

We draw our strength from our compact organisation and the autonomy it gives our employees, allowing them to express their full potential.

Our ability to maintain our appeal to new applicants and retain the talent already within our ranks is crucial for our continued development.

A compact and decentralised organisation

Eiffage is a compact and decentralised group firmly anchored in the regions it serves. We have built up a balanced and resilient business model thanks to our diverse and complementary activities.

Eiffage is defined by an organisation closely connected to the regions and countries where it operates. Our dense coverage representing our various business lines gives us fine-grained local knowledge of local areas and their unique identity, and allows us to better address the concerns of our public- and private-sector customers.

We are strengthening this model in Europe by acquiring very well-established companies to expand our geographical coverage and reinforce our areas of specialisation. Eiffage Énergie Systèmes has been the prime mover behind this acquisition drive as the energy services market remains highly fragmented. During 2024, we agreed or finalised 12 acquisitions, with a particular focus on Germany and the Netherlands.

Amid the brisk growth in our business lines, our priority is to nurture and retain what makes us different: being a European group with a human perspective.

Our compact organisation has remained intact throughout this period of organic growth and acquisitions. Today we have 84,400 employees – 20,000 more than seven years ago.

Our teams possess significant autonomy, and this helps cultivate entrepreneurial spirit and rapid decision-making. This culture makes a real difference when we are bidding for business or responding to unforeseen developments on projects.

We have established industrial capacity in Europe through several of our business lines so we can keep a tight grip on the value chain, quality, costs and lead times. Having this capability also enables us to meet specific customer needs by delivering tailored solutions.

Our roads business has around a hundred asphalt plants, such as the new Madrid unit inaugurated in 2024. We have ten metallic construction plants dedicated to manufacturing elements for offshore and onshore wind farms, structures and metal formwork. Two plants produce façades in France and Poland, and three production facilities in France are specialised in wood frames and prefabricated items. Finally, Eiffage Énergie Systèmes manufactures electronic cards and sub-assemblies, high-tech electrical switchboards, as well as maintaining and building rotating and static machinery at plants that are also located in France.

The decentralised nature of our organisation and the strong local presence of our various business lines create favourable conditions for synergies. Locally, our teams are able to promote an integrated approach based on turnkey solutions to customers and to compete effectively for complex large-scale projects. Where necessary, we can call in reinforcements from elsewhere.

Eiffage’s regional and country delegations are conducive to harnessing these synergies and sharing best practices. They act as an essential link on the ground anchoring our cross-disciplinary cooperation.

Eiffage’s stability is founded on the equilibrium between and the complementary nature of its business lines, and the substantial value they create. This equilibrium is underpinned by Contracting and Concessions segments, which operate over different timescales – the short term for Contracting and the long term for Concessions.

Today, our energy services business lines are growing rapidly, increasing their contribution relative to our construction and property development, and our concessions business lines. Our goal is to continue expanding on the foundations of these three business areas.

CONTRACTING

Our Contracting business, which accounts for 93% of the Group’s workforce, handles both large and smaller projects. Our order books reached a record level at year-end 2024, providing visibility for several years. Our business lines are growing at different paces as their fortunes are intertwined with the economic situation and its cyclical effects. In recent years, the downturn in newbuilds has been largely offset by the increase in renovation and the civil engineering, metallic construction and energy systems business lines. Energy systems in particular have delivered strong growth in France and the rest of Europe. Several major Eiffage Génie Civil projects will start up or continue over the next few years. The construction of metallic structures for the offshore wind energy market will again benefit our metallic construction business.

# EIFFAGE CONSTRUCTION

# EIFFAGE IMMOBILIER

# EIFFAGE AMÉNAGEMENT

# EIFFAGE ROUTE

# EIFFAGE GÉNIE CIVIL

# EIFFAGE MÉTAL

# EIFFAGE ÉNERGIE SYSTÈMES

CONCESSIONS

Our Concessions business, a source of stability and long-term visibility, requires major investments to which we are committed over the long term. We run major projects for public facilities, transport infrastructure, renewable energy production and buildings. Many of the concessions projects we have been awarded also generated business for our Contracting segment business lines. Over the past few years, we have been planning ahead for the expiry of motorway concessions we operate by diversifying our asset portfolio. The port and airport sectors and sustainable mobility have been at the forefront of this strategy. We have also strengthened our existing portfolio by increasing our stakes in certain of our concession companies.

In several steps since 2018, we have also become the leading shareholder in Getlink, the company holding the Channel tunnel concession until 2086.

# EIFFAGE CONCESSIONS

# MOTORWAY CONCESSIONS

-

Committed by conviction

The Vicoin viaduct at Saint-Berthevin (France) on the Bretagne-Pays de la Loire high-speed rail line that Eiffage will operate until 2036.

The ecological transition is an opportunity for all our business lines. Because the challenges are complex and interdependent, we consider them in a systematic manner.

We have adopted an ambitious strategy that genuinely makes a difference in how we execute our projects and operate our work sites. It directly impacts on our business model and transforms how we conduct our activities.

This integrated and structured strategy focuses on three key areas: reducing greenhouse gas emissions, protecting biodiversity and embedding a circular economy-based approach.

With a clear course ahead mapped out for them plus medium- and long-term objectives to reach, our divisions have drawn up operational action plans that are monitored and adjusted to the individual features of their activities and projects.

A bold climate carbon strategy

Eiffage’s ambitious climate carbon strategy targets short-term objectives in 2030 and aims for the Group to be fully carbon-neutral by 2050. Our SBTi-validated carbon trajectory is showing tangible results, which are published every year in the climate report, and they reflect teams’ initiatives.

The SBTi (Science-Based Targets initiative) validated Eiffage’s short-term (2030) greenhouse gas emissions reduction targets for Scopes 1, 2 and 3 in 2023, considering them to be aligned with the provisions set out in the Paris Agreement and the 1.5°C trajectory. In 2024, it approved our targets for reducing long-term greenhouse gas emissions over the long term (2050).

To lower our internal carbon emissions, we are primarily cutting the energy consumption of our industrial and commercial buildings, and of our vehicle fleets. To that end, we optimise our production tools and include emission factors in planning for the fleet upgrades. To lower our Scope 3 emissions, we make adjustments to our technical and commercial offerings, and introduce more low-carbon alternatives for our customers. At the same time, we need to factor in the acceleration in regulatory activity and the requirements of the European Green Deal.

Eiffage’s employees are fully engaged in the drive to decarbonise the Group. Our networks of low-carbon experts at the divisions, a model replicated in Belgium during 2024, help to disseminate the Group strategy and share best practices. In addition, we are receptive to new ideas through our various participation-based innovation programmes and offer specialised training, such as in environmental leadership for managers.

Our purchases, which account for more than 75% of Eiffage’s emissions, are a priority area of focus for us in our ecological transition. Decarbonising our purchases of products and services features highly on the roadmap for our Purchasing department. Our buyers support suppliers with implementing lower-carbon processes that are transforming our activities.

We are developing environmental data evaluation programmes, consolidating them and sharing them at every tier of the organisation. It is vital to safeguard the quality of data because they relate to our direct CO2 emissions and those of our purchases. We keep a close eye on the consumption of our facilities, our heavy plant and our vehicles.

We have developed Ecosource, a software application comparing the environmental performance of products, and carbon calculators geared to the specific needs of each business line so we can measure projects’ environmental impact accurately. Our teams can use these tools to help ensure they are marketing relevant offerings. In 2024, we launched the BlueOn platform, the first environmental data marketplace, and scaled up our traceability programme from wood initially to include other materials.

Eiffage and Impulse Partners set up Sekoya, a carbon and climate platform, in 2019 to encourage sustainable and innovative solutions for the construction industry. In its expanded form as a low-carbon industrial club with nine partners, Sekoya is contributing to provide a collective response to the climate emergency. Calls for solutions bring together and spark conversations between large construction groups and leading research companies, enabling them to develop their low-carbon materials and processes on a large scale. Since its creation, it has launched six calls for solutions and 30 companies have received awards.

BlueOn, a trailblazing initiative in the construction industry, is helping to transform the Group and the entire sector by providing a means of operationally integrating carbon data into the purchasing process. All the Group’s employees can access the marketplace, and by the beginning of 2025, it already incorporated a full life cycle analysis of nearly 30,000 products. BlueOn makes environmental data transparent, accessible and comprehensible, so that carbon emissions can be treated on the same footing as price.

QUESTIONS FOR…

Seynabou Wade

Head of Environmental Affairs and Innovation Eiffage Senegal

What does your role at Eiffage Senegal entail?

I’ve headed up the environmental team since 2020, and in February 2025, I was also put in charge of innovation. My main remit is to make sure teams respect and apply the environmental management system, and to champion innovation in all the organisation’s activities. That involves supporting, training and raising teams’ awareness, implementing innovative solutions, achieving environmental compliance by our installations and construction projects, and publicising and showcasing our initiatives to our stakeholders.

What activities is your team involved in?

In lock-step with the Group’s approach, we will publish our first carbon footprint, roll out the measures in the 2025–2030 biodiversity action plan and run a “Sustainable development tour” of construction projects and permanent sites to raise awareness and have conversations about sustainable development programmes. We also provide training on low-carbon solutions and publish a monthly sustainable development report.

To align its property portfolio with its carbon climate strategy, Eiffage seeks to maximise energy efficiency in its renovation activities. In Brussels, La Source, the new headquarters of Eiffage Construction’s teams in Belgium, has reduced its energy footprint by 62% by making improvements to its insulation, through re-use and biosourced materials, and through the installation of solar panels. In Saint-Ouen (France), Eiffage Construction’s teams in the Île-de-France region moved into La Distillerie, their new headquarters. While retaining the soul of the Ricqlès plant, the building has been completely renovated, with low-carbon materials, recycling and surplus site materials taking pride of place.

To help its customers decarbonise, APRR and ENGIE Vianeo have designed Europe’s first charging corridor for electric trucks. Five ultra-fast and very high power (400 to 480 kW) charging stations have been made available every 150 kilometres between Paris and Lyon (A5b and A6) in both directions. Two electric-powered trucks or coaches can be charged simultaneously in 45 minutes at these stations. The corridor aims to reduce greenhouse gas emissions from trucks, which account for 40% of France’s transport emissions.

-

02 Sustainability

statement -

2.1General information [ESRS 2]

2.1.1Methodological note

The provisions of the new European Corporate Sustainability Reporting Directive (CSRD) applied for the first time in the 2024 financial year and this sustainability statement was drawn up on that basis, taking into account the information and knowledge available at the time.

As well as being the first year that the CSRD has been in force, the year has also been fraught with uncertainty. In addition to the uncertainty surrounding the current state of scientific knowledge and the quality of the external data used, the texts are open to interpretation, and further clarification from the standard-setting or regulatory bodies is expected.

In this context, the Eiffage Group has endeavoured to apply the European Sustainability Reporting Standards (ESRS), as applicable on the date when the sustainability statement was prepared, on the basis of the information available when the sustainability statement was being drawn up.

This sustainability statement, the Group’s first, is characterised by specific contextual features due to the fact that this is the first year that the CSRD requirements apply:

- ■the absence of established practices, particularly for a more in-depth analysis of impacts, risks and opportunities (IROs) across the value chain or the definition of materiality thresholds (see sections 2.1.4 / Material impacts, risks and opportunities and their interaction with the business model [SBM-3] and 2.1.5 / IRO management and double materiality);

- ■the use of reporting boundary limits applied on a case-by-case basis to certain data as specified in relation to the values given in the thematic sections of this sustainability statement (see 2.1.1.1 / General basis for preparation of the sustainability statement [BP-1]and 2.1.1.2 / Information in relation to specific circumstances [BP-2]);

- ■some of the information required by the ESRS was not available at year-end 31 December 2024 due to the time constraints required for reporting this new information. The missing information relates to the disclosure requirements listed in the table below. For each of these, the actions planned by the Group and the timeframes involved are detailed in the sections mentioned in the table.

ESRS

Disclosure requirement

Missing or incomplete

informationReference

in the sustainability statementE1 Climate

changeE1 SBM-3 Adaptation to transition risks

Transition risks

2.3.2.2 Material impacts, risks and opportunities and their interaction with strategy and business model [ESRS 2 SBM-3]

E1 Climate

changeE1-3 Actions and resources

Action plans

2.3.3.2 Actions and resources in relation to climate change policies [E1-3]

E2 Pollution

E2-4 Pollution of air, water and soil

Information on these emissions

2.4.2.2 Pollution of air, water and land [E2-4]

E3 Water

and marine resourcesE3-2 Actions and resources related to water and marine resources

Identification of sites in water-stressed areas and actions related to water resources where appropriate

2.5.1.1 Description of the processes to identify and assess material water and marine resources-related impacts, risks and opportunities [ESRS 2 IRO-1]

E3 Water

and marine resourcesE3-4 Water consumption

Total water consumption in areas at water risk

2.5.2.2 Water consumption [E3-4]

E4 Biodiversity

and ecosystemsSBM-3

E4-5 Sites

impacting biodiversityIdentification of sites having an impact

2.6.2.1 Description of the processes to identify and assess IROs [ESRS 2 IRO-1]

E5 Resource

use and circular economyE5-4 Resource inflows

Quantitative information

2.7.2.2 Resource inflows [E5-4]

E5 Resource

use and circular economyE5-5 Resource outflows

Quantitative information (types of disposal); narrow reporting boundaries

2.7.2.3 Resource outflows [E5-5]

S1 Own

workforceReporting boundaries for certain data points (S1-8 Collective bargaining coverage S1-12 Percentage of employees with disabilities S1-14 Work-related ill health S1-16 Pay ratio and pay differentials)

Quantitative information;

narrow reporting boundaries

2.3.1.3 Indicators and objectives

G1 Business conduct

G1-6 Payment terms

Percentage of payments made on time

4.1.3.3 Payment terms [G1-6]

In this context, based on industry best practices and recommendations, as well as a better understanding of these new regulatory and normative provisions, the Group may need to review certain reporting and communication practices in future issues of its sustainability statement.

2.1.1.1General basis for preparation of the sustainability statement [BP-1]

- ■of Order 2023-1142 of 6 December 2023 on the disclosure and certification of sustainability information and the environmental, social and corporate governance obligations of commercial companies. This Order is the transposition into French law of European Directive 2022/2464 of 14 December 2022, known as the CSRD (Corporate Sustainability Reporting Directive);

- ■and of European Taxonomy Regulation (EU) 2021/2178.

The ESRS applicable to Eiffage were selected based on the material issues arising from the double materiality assessment carried out in 2023-2024. All ESRS apply to the Group.

This statement covers the entire value chain, taking into account both the Group’s own operations and its upstream and downstream value chain. For example, the double materiality assessment was conducted across the value chain as a whole.

The material impacts, risks and opportunities relating to the upstream or downstream parts of the Group’s value chain are shown in the table in section 2.1.4 / Material impacts, risks and opportunities and their interaction with the business model [SBM-3]. These IROs are dealt with in the relevant parts of the statement, as appropriate. In addition, greenhouse gas (GHG) emissions also encompass the entire value chain, as indicated in the table in section 2.2.3.4.3 / Gross GHG emissions [E1-6].

As defined in the CSRD, the scope of consolidation for the Group’s sustainability reporting is the same as that used for its financial statements. In general, companies fully consolidated in Eiffage’s consolidated financial statements are included in the scope of the sustainability statement. Some entities, particularly at Eiffage Route, whose financial indicators are not significant and which are therefore not consolidated in Eiffage’s financial statements, have been included in the non-financial reporting where relevant.

- ■for joint ventures in which Eiffage’s share of revenue is less than €5 million for the reporting year, 100% of the environmental data are reported if Eiffage manages the joint venture. Otherwise, they are not reported;

- ■when Eiffage’s share of the revenue of a joint venture is at least €5 million for the reporting year, the environmental data are reported in proportion to Eiffage’s share in the joint venture. The environmental data for such joint ventures will also be reported on a pro rata basis in subsequent years, regardless of the share of revenue for the reporting year in question.

- ■some subsidiaries acquired by the Group during the reporting period and included in the scope of consolidation of the financial statements for the 2023 financial year did not take part in the quantitative data collection exercise. Their numbers vary in the following cases:

- ❯with regard to social data, 36 subsidiaries did not take part in the 2024 campaign. Of these, 9 do not use the Group’s reporting tool and have fewer than 50 employees. The other 27 were unable to take part in the campaign for organisational reasons,

- ❯with regard to environmental data, 41 subsidiaries did not take part in the 2024 campaign. Of these, 10 have a non-significant environmental impact because of the nature of their business and have fewer than 20 employees. The other 31 were unable to take part in the campaign for organisational reasons;

- ■of the subsidiaries included in the scope of consolidation of Eiffage’s financial statements during the 2024 financial year, only the most significant companies, namely EQOS, Salvia and Van den Pol, have been included within the scope of the sustainability statement. These subsidiaries were selected based on their workforce (more than 250 employees) and their annual revenue (in excess of €50m). Note that environmental data of the EQOS Group were estimated from quantitative information for 2023, to which the annual growth rate between 2023 and 2024 was applied. Support will be provided for 32 other, smaller subsidiaries that joined Eiffage in 2024 so that they can report from the 2025 financial year.

Consequently, taking the exclusions described above into account, the coverage rates for quantitative information correspond to:

- ■98.6% in terms of workforce, for the social component;

- ■99.0% in terms of revenue, for the environmental component.

Some quantitative data have a lower coverage rate due to the lack of information from companies other than those listed above. This concerns the following information relating to the social and environmental components:

- ■Social data: some quantitative information is only disclosed for France, which corresponds to a coverage rate of about 64% in terms of workforce for the data in question. Given the type of information, estimates would not provide quality results. More work is needed for entities based outside France, on the one hand to clarify certain definitions in accordance with local regulations, and on the other hand to ensure harmonised, high-quality data collection and consolidation across the Group as a whole. The aim is to cover the entire Group within three years. Trial collection of some of these data began in the 2024 financial year.

- The data for which the reporting boundaries are limited to France can be seen in the headings of the relevant tables. This relates to certain data points for the following disclosure requirements: Overview of the workforce [S1-6], Overview of non-salaried employees [S1-7], Collective bargaining agreements and social dialogue [S1-8], Diversity [S1-9], Inclusion [S1-12], Training [S1-13], Health and safety [S1-14], Compensation [S1-16] and Incidents, complaints and severe human rights impacts [S1-17].

- For accident frequency and severity rates, the coverage rate is 94.3% in terms of number of employees.

- ■Environmental data: narrow reporting boundaries apply for quantitative information relating to the disclosure requirement on resource outflows E5-5. Efforts are made each year to extend the reporting boundaries. This relates to:

- ❯the quantities of waste generated that are disclosed for France, Germany, the Benelux countries, Spain and the UK, representing a total of 92% of the Group’s revenue;

- ❯information on waste treatment that is disclosed for France, Belgium, Luxembourg and Spain, representing a total of 76% of revenue. In 2024, data from Belgium and Luxembourg were included in the data disclosed on these indicators.

The methodological note detailing the process for determining taxonomic indicators, as well as the regulatory taxonomic tables, is included as an appendix to this sustainability statement.

2.1.1.2Information in relation to specific circumstances [BP-2]

This section summarises all the specific circumstances that applied when drafting this statement, as required by ESRS 2.

- ■short term (ST): one year (“the period adopted by the company as the reporting period in its financial statements”);

- ■medium term (MT): more than one year and up to five years;

- ■long term (LT): more than five years.

The quantitative information relating to Scope 3 GHG emissions has been estimated. This is mentioned below the emissions table in section 2.2.3.4.3 / Gross GHG emissions [E1-6]. Some of these estimates involve a high level of uncertainty, for example those based on a monetary amount. Generally speaking, as part of a continuous improvement drive, the Group is working to improve the collection and consolidation of quantitative information using the Group’s existing tools and processes.

The quantitative information on GHG emissions for the year ended 31 December 2024 has been extended to some Eiffage Route entities that are not part of the scope of consolidation and that were not included in the quantitative information on GHG emissions disclosed in the non-financial performance statement for the 2023 financial year. This scope has been extended to include subsidiaries over which the Group has operational control.

In addition, Scope 1 and 2 GHG emissions for the 2019 reference year were recalculated for international entities during the 2024 reporting campaign, after the reporting boundaries for consumption indicators were extended. This is because some indicators only applied to France during the 2019 financial year.

The GHG emissions table in section 2.2.3.4.3 / Gross GHG emissions [E1-6] shows the Scope 1 and 2 emissions calculated for 2024 and recalculated for 2019 (reference year) and 2023, based on the reporting boundaries used for 2024 (see text below the table).

Three cogeneration plants had not been reported since they joined the Group due to an oversight and were therefore an unintentional omission. The energy consumption data and GHG emissions for these three plants have been included in the 2019, 2023 and 2024 data to rectify this error.

The information from other legislation requiring the Group to disclose sustainability information is listed in the tables under other European and French regulations, appended to this statement.

Lastly, as the Group has incorporated information by means of cross-references, this information is listed in the table below.

Data points

Reference document

Section of the reference document

ESRS 2 GOV-1,

para. 19,20,21

Universal Registration Document

Board of Directors’ report on corporate governance

Corporate governance – Preparation and organisation of the Board of Directors’ work

ESRS 2 GOV-2

para. 26

Universal Registration Document

Board of Directors’ report on corporate governance

Corporate governance – Preparation and organisation of the Board of Directors’ work/Board of Directors’ work

ESRS 2 GOV-3,

para. 29

Universal Registration Document

Board of Directors’ report on corporate governance

Variable compensation policy for corporate officers

ESRS 2 GOV-5

Universal Registration Document

Directors’ Report

Risk management system

ESRS S1 S1-16

Universal Registration Document

Board of Directors’ report on corporate governance

Corporate officers’ total compensation packages/ Table of pay ratios for the Eiffage Group in France as required by Article L.22‑10‑9‑I, 6° and 7° of the French Commercial Code

-

2.2.Environmental information

2.2.1How Eiffage is making its ecological transition

Over the past fifteen years, Eiffage has been committed to reducing the impact of its activities and continues to intensify its efforts to further an ecological transition that is vital for everyone. Economic activities cannot be sustained unless the principles of sustainable action are observed. This means working to decarbonise activities and limit the extraction of natural resources (materials and water), and systematically avoiding, reducing and offsetting our impacts on ecosystems and biodiversity. Eiffage’s environmental strategy has given it a roadmap for deploying concrete and realistic action plans in each of its divisions, which are gradually finding their place in new business models.

The ecological transition of the business model

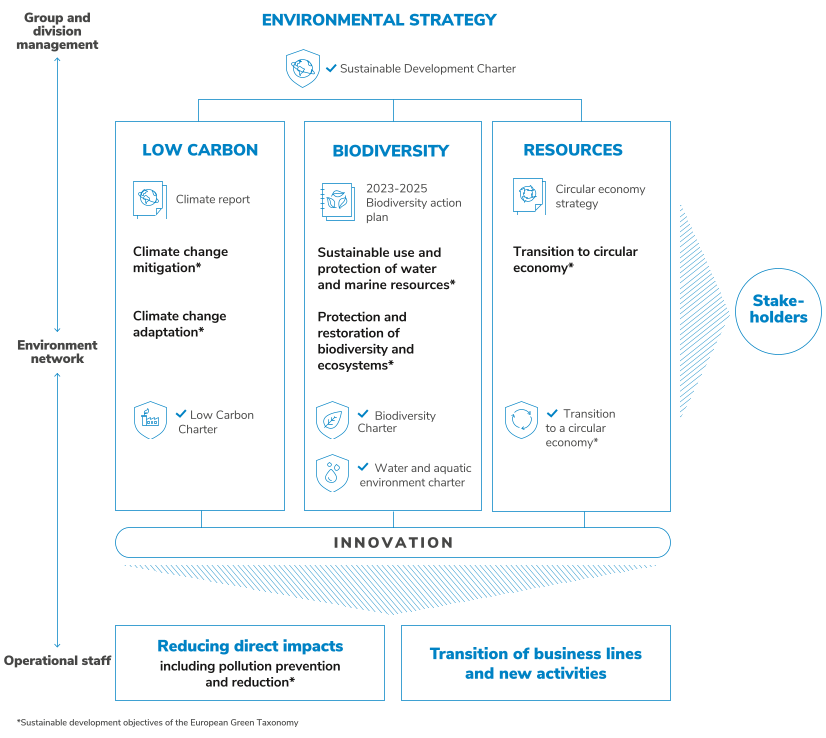

This diagram shows the ecological transition of the Group’s business model. The Group’s environmental strategy, which includes three pillars (Low Carbon, Biodiversity and Resources/Circular Economy), is applied to all levels of governance (Group and division management, Environmental network and operational staff). These three complementary strategies, fuelled by a culture of multidisciplinary innovation, contribute to controlling the direct impacts of the Group’s activities, the transition of business lines and the development of new activities, while at the same time meeting the expectations of stakeholders. Each pillar of the environmental strategy details the actions and tools implemented as well as the sustainable development objectives of the European Green Taxonomy to which they respond:

- Low-carbon: climate report and low-carbon charter.

Objectives: climate change mitigation and adaptation to climate change

- Biodiversity: 2023-2025 biodiversity action plan, biodiversity charter and water and aquatic environments charter.

Objectives: sustainable use and protection of aquatic and marine resources, protection and restoration of biodiversity and ecosystems

- Resources: circular economy strategy and circular economy charter.

Objective: Transition to a circular economy

2.2.1.1The coordination of Eiffage's environmental strategy

The Group’s environmental strategy is overseen by the Sustainable Development and Transversal Innovation Department (SDTID), which advises the divisions on environmental protection and environmental risk prevention. The SDTID monitors environmental issues for legal, regulatory and competitive developments and ensures that its environment expert and innovation networks disseminate environmental knowledge uniformly throughout the Group’s divisions and operational departments, most notably by organising environmental training courses.

- ■monitor and co-ordinate the deployment of the Group’s strategies in the four divisions, by designing and developing tools for monitoring and implementing action plans, often through cross-functional innovation;

- ■create and co-ordinate environmental training courses for worksite supervisors, engineering office staff, sales people and other cross-functional personnel;

- ■provide the technical, organisational and legal support the divisions need to manage environmental risks during the project design, construction and operation phases;

- ■develop ambitious environmental solutions that operational teams can include in their tenders.

In addition, the SDTID assists the Group’s cross-functional departments that are involved in the ecological transition, namely the Purchasing, Human Resources, Internal Audit and Compliance, Finance and Accounting departments and the engineering and innovation functions. Reporting directly to the Group’s Chairman and CEO, the SDTID sits on the Group Management Committee, attends some meetings of the Executive Committee, and is consulted by the Board of Directors’ Strategy and CSR Committee, and by the Audit Committee to validate ESG data consolidation processes.

In 2024, the SDTID actively expanded the scope of its actions. An SDTID expert was recruited for the BeLux entities. Based in Brussels, this person assists local teams in deploying the environmental strategy, sharing the Group’s best practices and tools, and coordinating the management of ESG data. Furthermore, the "envirotours" conducted in France in 2018 and 2019 were resumed in the second half of 2024 in six French regions and in Brussels. These half-day events are an opportunity to engage with employees and raise their awareness of the challenges of the ecological transition, for example, by presenting the “2tonne” workshop and sustainable development initiatives that were employed for local projects. At these events, Eiffage’s Executive Management makes sure to remind that the ecological transition is a collective undertaking that is vital to ensuring the development of the Group's activities and to improving the quality of life in local communities. These new envirotours have enabled the training of 36 leaders of 2tonnes workshop in France and BeLux, and the awareness-raising of 540 employees. The envirotours will continue in 2025 in the other regions of France and in other countries where Eiffage is present.

2.2.1.2Developing the environment network in the divisions

Over the past few years, the environment network has been strengthened in each division and continues to adapt its organisation to meet the growing challenge of environmental compliance in the construction and motorway concessions industries.

Construction division – The Quality, Safety and Environment Department was restructured in early 2024, and the environmental management system (EMS) was revised to deal with environmental risks more effectively. Pricing analysts in France are trained in new pricing processes and in the FinalSafe software, which facilitates the monitoring of environmental and health-safety action plans. A data management interface that will enable the real-time monitoring of action plan progress is also being developed. The environment network is currently being deployed internationally. An environment expert has been appointed for the Benelux countries, where FinalSafe will be deployed in 2025, initially in French and subsequently in Walloon and Flemish. National environment experts are currently being recruited in Switzerland and Poland, which will enable the deployment of FinalSafe in these countries.

Infrastructure division – This division has two distinct certification scopes: one for the Road business lines and another for Civil Engineering and Metalllic Construction. Monthly meetings are held to share information and experience between these two scopes and co-ordinate their actions. Each operational department has one or more low-carbon experts. The network of low-carbon experts is managed separately for each scope and coordinated at the division level.

- ■Eiffage Génie Civil | Métal - The Quality, Environment (QE) and Low-Carbon Department assists European and Senegalese subsidiaries and business lines in achieving the Group’ objectives. This includes monthly QE meetings with the French network, meetings with subsidiaries in Belgium, Germany, Spain and Senegal every two months, low-carbon meetings with the French-speaking network and low-carbon events with European subsidiaries every two months. To encourage the exchange of information and the sharing of best practices, low-carbon meetings may also be attended by low-carbon experts from other divisions, the SDTID, equipment department personnel and the Purchasing Department’s low-carbon experts.

- ■Eiffage Route – The CSR Performance Department has established a common policy and roadmap to accelerate the implementation of Eiffage's Horizon 20-25 strategy plan and its associated environmental action plans in all Road business lines. Action plan progress and results are monitored quarterly with the business line managers. A steering committee composed of one low-carbon expert from each region specifies low-carbon actions for each of the divisions’ quarries.

Energy Systems division – The seven members of the division's Quality, Safety and Environment (QSE) Department work in liaison with the QSE managers of the French regional divisions and European subsidiaries. In 2024, the recruitment of an international coordinator was undertaken to organise the environmental actions of the division’s international entities.

Concessions division – The division's Technical Department coordinates collaborative work between the concession subsidiaries and the head office, by proposing uniform processes and disseminating best practices for projects. Within this department, the CSR team works to engage project owners in supporting the societal and environmental objectives of the division and the Group.

APRR-AREA – The division’s ecological transition is overseen by the Infrastructure and Concessions Department, which ensures that the division’s objectives are aligned with those of the Group. It is supported by the Ecological Transition, Innovation and Development Department, and theOperations and Property Assets departments. The Property Assets Department's Environment Unit assists the Operations Department in complying with the environmental regulations that apply to motorway construction and maintenance, and in monitoring and managing any associated offset measures. Once to twice a year, the Environment Unit brings together some twenty employees to discuss new initiatives and their implementation, work methods and innovative approaches.

2.2.1.3 Environmental watch

Eiffage has equipped all of its divisions with an effective solution for monitoring compliance with environmental regulations. This solution’s tools and legal advisory service give Eiffage’s divisions in France online access to up-to-date regulatory compliance information for all of their sites. The SDTID uses this information to issue a monthly environmental regulatory intelligence newsletter that is distributed internally. This newsletter serves to:

- ■highlight key environmental regulations;

- ■ensure that operational staff understand these regulations;

- ■show how these regulations relate to current events and regulatory issues;

- ■centralise regulatory information and the Group's various guides.

2.2.1.4Cross-functional innovation to accelerate Eiffage's strategies

As a construction and motorway concessions group, Eiffage uses various means to deploy innovation, for example, in laboratories that develop a specific product or process, during a project’s design phase, at a worksite, or via cross-functional workgroups. By combining multiple disciplines and support expertise in such areas as purchasing, legal and sustainable development, cross-functional workgroups accelerate the process of transforming an innovative idea into a marketable product or service. All Eiffage business lines work with industry leaders to find new solutions in their respective areas of expertise.

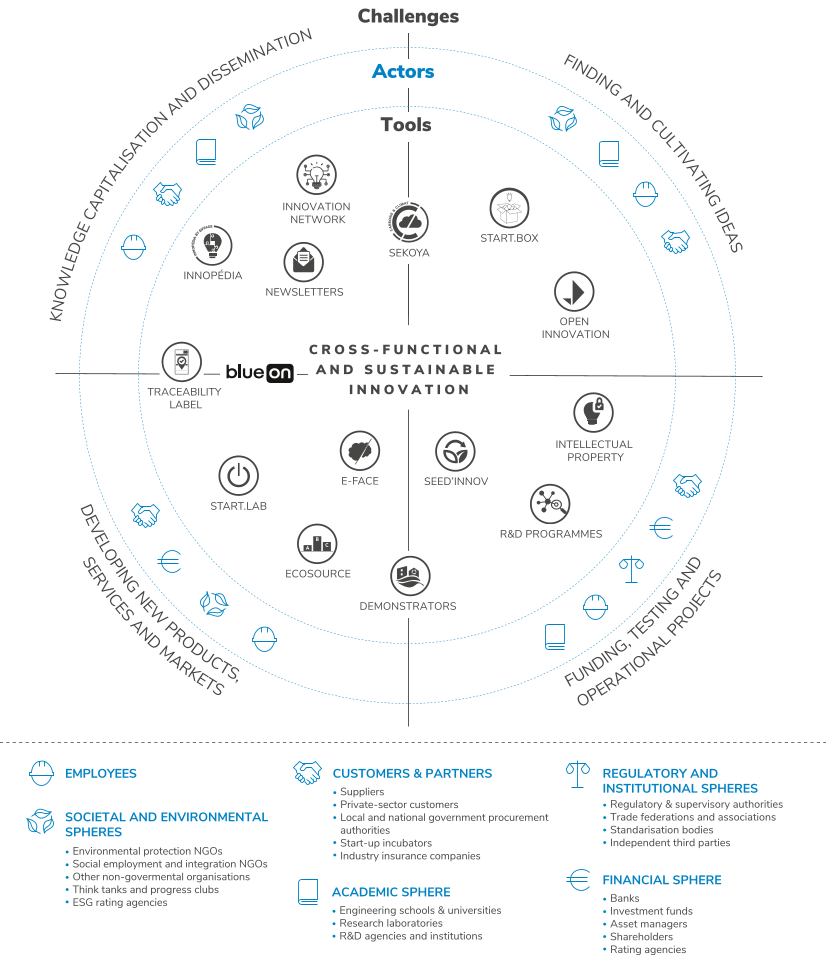

An ecosystem of innovation for the environmental strategy

This infographic presents the tools, players and challenges of the innovation disseminated and shared within the Group and with its external stakeholders. The tools for participatory and inclusive innovation are presented in the centre of the infographic, the players are represented by pictograms in the intermediate circle, and the issues presented outside the circle make it possible to distribute tools and players according to five challenges:

- “Referencing, disseminating” challenge:

Players: academia, customers and partners, employees, social and environmental spheres Tools: Innopedia, newsletters, innovation network, Sekoya, traceability labels, Blue On.

- “Building the offer and developing new markets” challenge

Players: customers and partners, financial sphere, social and environmental spheres, employees Tools: start.Lab, e-Face, Ecosource, demonstrators, traceability labels, Blue On.

- “Financing, testing and supporting operational projects” challenge

Players: academia, employees, regulatory and institutional spheres, financial sector, clients and partners Tools: demonstrators, seed-Innov, R and D programmes, intellectual property

- “Sourcing, bringing out ideas” challenge

Players: academia, employees, customers and partners, social and environmental spheres Tools: start.box, Sekoya, open innovation

To assist them with this task, the Group’s divisions can count on the expertise of the Sustainable Development and Transversal Innovation Department (SDTID), which coordinates Eiffage’s overall innovation system and reports directly to its Chairman and CEO. Efforts to set up and launch a Group-wide innovation network came to fruition in May 2024 at a one-day innovation event that was attended by all business lines. The Group's Chairman and CEO took this opportunity to reaffirm that the objectives of this inter-division network are to promote the sharing of experience and ideas between business lines, promote cross-functional innovation projects throughout the Group, and increase the involvement of international subsidiaries.

The SDTID deploys a multitude of means to stimulate innovation. For example, innovative solutions and achievements are featured on the Group's Innopédia collaborative platform, which was revamped in 2024.

→2.2.1.4.1Eiffage's innovation funds

Both of the Group's funds work to strengthen its culture of innovation, accelerate the ecological transition and develop differentiating solutions. The E-Face fund finances the cost difference between a conventional technology, material or other solution and a lower carbon emissions alternative. As for the Seed'Innov fund, it co-finances up to 50% of the eligible expenditure of an innovative project, for research, investment, experimentation, etc.. For example, in 2024 Seed'Innov funded a logistics platform in the Lyon metropolitan area that promotes the recycling and reconditioning of finishing materials from deconstruction sites while providing back-to-work employment.

In addition to the fund's Group-wide efforts to support projects that involve multiple business lines, in 2023 Seed'Innov funds were set up within the divisions to support projects that are specific to their business lines. This redefinition of Seed’Innov’s activity has increased its budget by over 85% and has already resulted in the launching of 10 new division-specific projects. One example is a demonstrator two-storey building in Brittany constructed with compressed earth bricks made from excavated and recycled soil.

→2.2.1.4.2Other measures to stimulate innovation

The Group's efforts to promote in-house innovation also include the Start.box suggestion box, Start.lab internal workgroups, and Sekoya calls for solutions.

In 2024, the Start.box engaged employees in eight Group-wide and business-line specific innovation campaigns. For example, 941 employees participated in the "In between 2 waters" campaign, launched on World Drought Day, with a total of 138 ideas contributed, such as how to recover rain water at construction camps for use at worksites.

Sekoya – the industrial club created in 2017 in partnership with Impulse Partners – aims to accelerate the implementation of sustainable and innovative solutions in its members' projects. In 2024, the 6th Sekoya call for solutions got over 80 start-ups and SMEs thinking about "How data can improve environmental performance" and "Eco-sufficient construction solutions". Over the six years of Sekoya’s existence, over 350 innovative solutions have been submitted by start-ups and small to mid-size companies. Of these, 30 have been selected for further development and some 20 trial projects have been launched with the Sekoya's partners.

→2.2.1.4.3Eiffage's partnerships with innovation actors

Gustave Eiffel University is one of the universities with which Eiffage has been working for many years. Eiffage Route's R&D teams are supervising and financing a PhD thesis within the framework of the European Cofund Cleardoc project to research, develop and characterise paving materials specifically designed for urban heat islands. The project's objective is to reduce the surface temperature of pavements by optimising their evaporative properties. This innovation could subsequently be tested at Eiffage Route's site in Hyères, which has already hosted an urban cool island demonstrator.

Orra is an optimised rolling resistance asphalt the development of which was spearheaded by Eiffage Route within the framework of the I-Street project’s "Asphalts of the Future" module. A laureate of Cerema's CIRR roads and motorways innovation competition in 2022, Orra came back into the spotlight in 2024 with:

- ■an internship at Eiffage Route's CERF R&D and training centre, in Corbas, which enabled the development of new methods for assessing the textural properties of pavements in relation to their rolling resistance.

- ■a trial project on the A49 motorway, conducted under the aegis of the CIRR, that will enable Gustave Eiffel University to use a specially equipped vehicle to measure rolling resistance in situ.

For several years now, the use of green chemistry to make asphalt mixes is also being explored. In 2024, at the TRA congress in Dublin, a Gustave Eiffel University researcher presented the university's work to develop the Biophalt asphalt for the Irish Department of Transport. By the end of the year, this work resulted in the first road construction project in Ireland to use this new asphalt.

Ceebios, which provides research and consultancy services in biomimicry technologies, is another long-standing partner of Eiffage. Eiffage is leveraging Ceebios' expertise to familiarise its business lines with some practical applications of biomimicry, which looks to nature for innovative solutions to the challenges of sustainable development. This partnership includes online resources, a series of conferences, and participation in a network of academic and entrepreneurial partners. Already aware of the potential of biomimicry technologies, Eiffage entities were able to draw on Ceebios' expertise in 2024 to see how nature’s strategies could help them meet their needs in terms of materials, products and solutions for urban environments. This effort is being pursued, with the aim of producing the first proofs of concept in 2025, which will enable the development of prototypes. Eiffage also contributed to the Biomim'City Lab, which brings together construction project owners and managers who are working to use biomimicry technology to accelerate the development of the regenerative city.

Since 2022, Eiffage has also been involved in the Low-tech Group, led by Paris&Co. After months of work, in 2024 Eiffage and its partners BNP Paribas Real Estate, GRDF, Groupama Immobilier and SNCF Immobilier, with the support of AREP and ADEME, issued a guide promoting the development of low-tech cities. The low-tech approach seeks to meet environmental challenges by ensuring that projects are tailored for their environments, so that they are useful, eco-sufficient and sustainable. The low-tech guide is designed to enable all urban development actors to understand and support a low-tech approach. Intended for project designers, contractors and users, the guide comprises 14 how-to documents, with examples of the co-benefits, indicators and inspiring projects of the low-tech approach.

2.2.1.5Training and awareness-raising, the backbone of Eiffage's environmental strategy

→2.2.1.5.1More environmental training

The SDTID's 2023 review of training in the divisions resulted in an overhauling of training programmes in 2024, with the objective of harmonising training initiatives between the divisions and ensuring that they are relevant to job profiles. All divisions reported a need for more training of line managers.

- ■creating an environmental leadership training course for managers, to enable them to:

- ❯understand business-specific environmental impacts;

- ❯identify the main environmental risks;

- ❯make the Group's environmental strategy a lever for growth and deploy it effectively within the overall strategy plan;

- ❯inform employees about environmental issues and get them involved.

This training will be rolled out in 2025 to all managers of profit centres and support functions, including top managers;

- ■identifying the target profiles and an appropriate training path for each one. This involves the following three steps:

- ❯determining the target profiles within the job categories to be prioritised for training (e.g. construction, engineering, sales, management, support functions, etc.);

- ❯creating, in collaboration with Human Resources departments, a table of environmental training objectives that matches the target profiles with knowledge and skills requirements;

- ❯mapping out the Group's environmental training programmes.

This work has made it possible to identify jobs for which insufficient or even no training is provided, and to prioritise the need for environmental training for positions that are environmentally strategic. The ultimate aim is to determine a minimum requirement of environmental competence for each job category.

- ■developing a tool for monitoring environmental training, with quantified objectives, which are currently being determined within the divisions. This tool will serve to:

- ❯monitor the training efforts of the divisions and consequently each business line's engagement in the ecological transition as reflected in its environmental training plan;

- ❯enable the divisions to monitor their progress and thus manage their environmental training plans more easily and effectively;

- ❯consolidate Group and division environmental training reports.

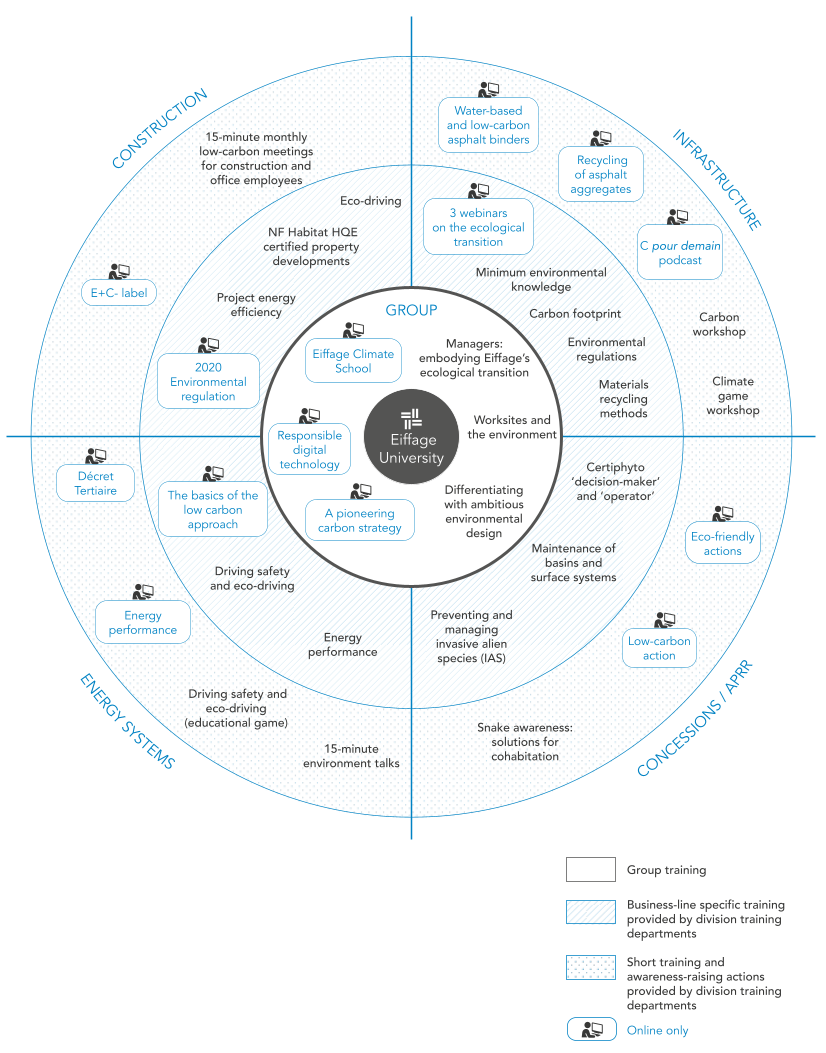

Eiffage's environmental training

This infographic presents the environmental training courses offered within the Eiffage Group in 2024.

Eiffage University is represented in the centre. The circle that directly surrounds it includes training provided at Group level (Eiffage Climate School, Responsible Digital Services, Pioneering Carbon Strategy, Differentiating yourself through an ambitious environmental design, Construction sites and the environment and Managers: embodying Eiffage’s ecological transition). The first three training sessions are delivered exclusively online.

The following two circles are divided into four quarters, one per business unit: Construction, Infrastructures, Concessions/A P R R and Energy Systems. The intermediate circle lists the specific training provided by the division training departments. The external circle presents short training courses and job awareness sessions carried out by the division training departments.

For the intermediate circle, the specific business line training available for each business unit is as follows:

- Construction: 2020 environmental regulations (e-learning), Energy efficiency of a project, N F Habitat H Q E certified real estate operation, Eco-driving;

- Infrastructures: Minimum environmental knowledge, Carbon footprint assessment, Materials recycling techniques, three webinars on the ecological transition (e-learning), Environmental regulations;

- Concessions/A P R R: Certiphyto “decision maker” and “operator” certification, Maintenance of catchment areas and surface networks, Preventing and managing invasive alien species (I A S);

- Energy Systems: energy performance, road and eco-driving risks, fundamentals of the low-carbon approach (e-learning).

For the outer circle, the short training sessions and business line awareness sessions for each business unit are as follows:

- Construction: E+C- label (e-learning), monthly low-carbon quarter-hour sessions at construction sites and offices;

- Infrastructures: hydraulic and low-carbon binders (e-learning), recycling of asphalt aggregates (e-learning), “C for tomorrow” podcast (e-learning), carbon workshop, climate fresco workshop;

- Concessions/A P R R: Eco-gestures (e-learning), Acting low carbon (e-learning), Awareness of snakes: solving cohabitation problems;

- Energy Systems: tertiary decree (e-learning), energy performance (e-learning), road risks and eco-driving (educational site), environmental quarter-hour sessions.